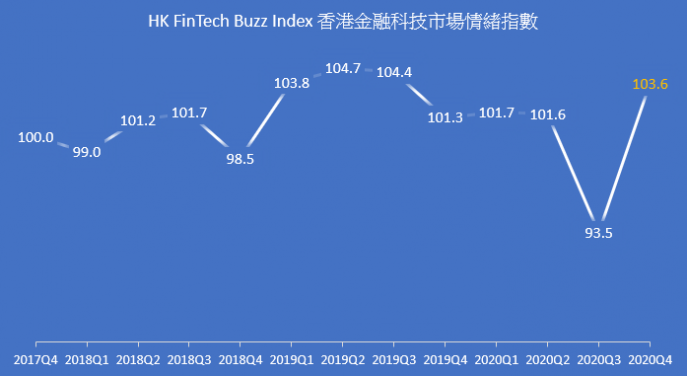

Hong Kong FinTech Buzz Index rebounds in 2020Q4

09 Mar 2021

Hong Kong FinTech Buzz Index (FBI) is a quarterly index which represents a quantified sentiment of the local FinTech-related news articles in local Chinese news media.

According to the 2,426 news articles analysed in the last quarter of 2020 (October to December), Hong Kong FBI for the fourth quarter (Q4) of 2020 rebounds to 103.6, a sharp increase of 10.1 index points (or 10.8%) from the third quarter. Year-on-year (YoY) change is increased by 2.3 index points (or 2.27%)

|

Period |

InsurTech |

WealthTech & CreditTech |

Blockchain & Cryptocurrency |

Payment & Digital Banking |

RegTech & Cybersecurity |

Supporters & Others |

|

Q1, 2019 |

104.8 |

104.9 |

104.0 |

105.0 |

91.5 |

106.1 |

|

Q2, 2019 |

106.0 |

107.7 |

108.7 |

105.4 |

73.2 |

109.6 |

|

Q3, 2019 |

99.2 |

104.6 |

105.3 |

109.3 |

90.9 |

106.5 |

|

Q4, 2019 |

98.9 |

100.8 |

103.7 |

106.4 |

79.9 |

104.1 |

|

Q1, 2020 |

101.5 |

101.1 |

102.6 |

104.0 |

94.1 |

101.9 |

|

Q2, 2020 |

104.2 |

103.1 |

99.1 |

102.9 |

98.6 |

100.6 |

|

Q3, 2020 |

100.8 |

107.4 |

67.9 |

102.7 |

80.7 |

105.4 |

|

Q4, 2020 |

101.4 |

108.9 |

100.1 |

103.5 |

98.9 |

106.9 |

All six sectoral indices moved upward mainly because of a series of activities between Hong Kong and the Greater Bay Area. Among six sectors, the Blockchain & Cryptocurrency sectoral index recorded the largest increase of 32.2 index points (or 47.4%) because of the completion of the first batch of blockchain-based cross-border trade transactions and the first trade finance transaction upon the connection of Hong Kong’s innovative trade finance platform eTradeConnect and the Mainland’s Trade Finance Platform. A roadmap developed by HKMA to promote RegTech adoption in the Hong Kong banking sector, announced in the HK FinTech Week, also brought good news to the RegTech & Cybersecurity sub-sector. Meanwhile, bitcoin scam involving an amount of 1000 bitcoins created negative impacts on both Blockchain & Cryptocurrency and RegTech & Cybersecurity sub-sectors, resulting in normal levels around 100.

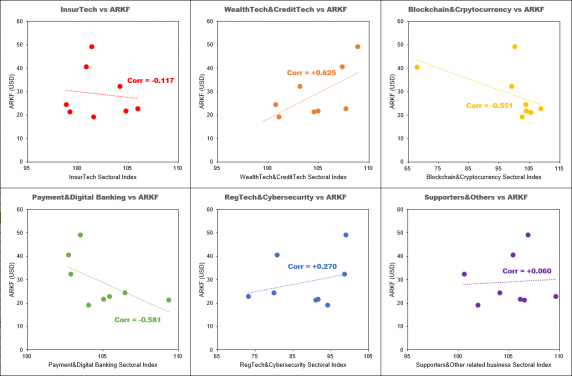

The correlation between the WealthTech&CreditTech sectoral index and ARKF is +0.625. It is suggested that the development of WealthTech sector tends to cover more international investments.

About the HKU FinTech Index Series Project

The HKU FinTech Index Series Project introduces the Hong Kong FinTech Growth Index (FGI) and the Hong Kong FinTech Buzz Index (FBI) to gauge local FinTech companies' outlook on the industry and the general sentiment on the sector as reported by local press. It is the first in the region to provide index indicators on the development of the sector, with an aim to provide information in a timely manner to track the growth and development of the financial technology industry in Hong Kong.

FGI is a yearly index with four sub-indices on Business Environment, Business Performance, Investment on R&D and Demand on Talent. It reflects Hong Kong FinTech sector's forecast of the market situation in the coming year and an assessment of the situation in the current year. FBI is a quarterly index representing a quantified sentiment of the local FinTech-related news articles in Chinese in the past three months. The index has a base value of 100 points which represents the sentiment of nearly 10K FinTech related news articles in major local news media outlets in 2016 and 2017. FBI is further broken down into six sectors: Insurance Technology (InsurTech), Wealth Management and Credit Technology (WealthTech & CreditTech), Blockchain & Cryptocurrency, E-Payment & Digital Banking, Regulatory Technology (RegTech) & Cybersecurity and other related business including AI and big data.

The project is led by Prof. S.M. Yiu, Professor, Department of Computer Science, HKU, and Prof. Philip Yu, Honorary Professor, Department of Computer Science, HKU; Professor, Department of Mathematics and Information Technology, EdUHK, and funded by The University of Hong Kong - Standard Chartered Hong Kong 150th Anniversary Community Foundation FinTech Academy.

To provide professional insight, the Advisory Board is established, comprising professionals from the University of Hong Kong and the local FinTech industry, including representatives from FinTech Association of Hong Kong, InvestHK, Cyberport, Hong Kong Science and Technology Parks Corporation, and The Bank of East Asia, Limited. The members provide expert advice on the FinTech companies to be included in the master list for the annual survey to return the FinTech Growth Index. They also advise the Project on index methodology.

For further information on the HKU FinTech Index Series Project, please visit the project's website at www.fintechindex.hku.hk.

About The University of Hong Kong - Standard Chartered Hong Kong 150th Anniversary Community Foundation FinTech Academy

The University of Hong Kong - Standard Chartered Hong Kong 150th Anniversary Community Foundation FinTech Academy ("the HKU-SCF FinTech Academy") was established in April 2020 with a mission to make a sustainable impact in FinTech by grooming world-class talents and leading innovative research to further strengthen Hong Kong's position as an international financial centre.

Through a commitment of HK$60 million from the Standard Chartered Hong Kong 150th Anniversary Community Foundation, the HKU-SCF FinTech Academy is steered by Faculty of Engineering, with support from Faculty of Law as well as Faculty of Business & Economics of The University of Hong Kong.

For media enquiry:

Ms Melanie Wan, Communications and Public Affairs Office, HKU (Tel: 2859 2600 / Email: melwkwan@hku.hk),

Prof. S.M. Yiu, Department of Computer Science, HKU (Email: smyiu@cs.hku.hk), or

Prof. Philip L.H. Yu, Department of Computer Science, HKU; Department of Mathematics and Information Technology, EdUHK (Email: plhyu@cs.hku.hk, plhyu@eduhk.hk)