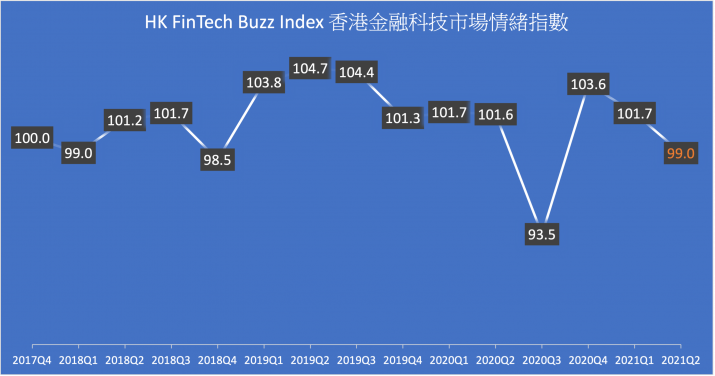

Hong Kong FinTech Buzz Index moderately drops in 2021Q2

08 Nov 2021

The HKU FinTech Index Series Project published the 2021Q2 Hong Kong FinTech Buzz Index (FBI) to gauge local FinTech companies’ outlook and the general sentiment on the sector as reported by the local press.

Hong Kong FinTech Buzz Index – 2021Q2

Having analysed 1,064 news articles posted between April and June 2021, the Hong Kong FBI for the second quarter (Q2) of 2021 is computed to be 99.0, showing a moderate decline of 2.7 index points (or 2.7%) from 101.7 in the first quarter in 2021 (2021 Q1).

Table 1. Result of FBI

|

Period |

InsurTech |

WealthTech & CreditTech |

Blockchain & Cryptocurrency |

Payment & Digital Banking |

RegTech & Cybersecurity |

Supporters & Others |

|

Q1, 2019 |

104.8 |

104.9 |

104.0 |

105.0 |

91.5 |

106.1 |

|

Q2, 2019 |

106.0 |

107.7 |

108.7 |

105.4 |

73.2 |

109.6 |

|

Q3, 2019 |

99.2 |

104.6 |

105.3 |

109.3 |

90.9 |

106.5 |

|

Q4, 2019 |

98.9 |

100.8 |

103.7 |

106.4 |

79.9 |

104.1 |

|

Q1, 2020 |

101.5 |

101.1 |

102.6 |

104.0 |

94.1 |

101.9 |

|

Q2, 2020 |

104.2 |

103.1 |

99.1 |

102.9 |

98.6 |

100.6 |

|

Q3, 2020 |

100.8 |

107.4 |

67.9 |

102.7 |

80.7 |

105.4 |

|

Q4, 2020 |

101.4 |

108.9 |

100.1 |

103.5 |

98.9 |

106.9 |

|

Q1, 2021 |

106.0 |

106.2 |

91.1 |

103.3 |

111.6 |

108.7 |

|

Q2, 2021 |

100.9 |

98.3 |

89.1 |

100.6 |

99.5 |

105.1 |

A drop is recorded across all six sectors of the FinTech Buzz index. The sectorial index of RegTech & Cybersecurity experienced the greatest decrease, owing to the emergence of investment scams and data leakage in Hong Kong. For example, there was a massive data leak which exposed 500 million LinkedIn users' information. With regards to InsurTech, WealthTech & CreditTech as well as Payment & Digital Banking, the negative sentiment could be attributed to frauds associated with popular online payment apps and the fact that some virtual banks were revealed to be suffering from deficits. Additionally, scams associated with cryptocurrency trades were prevalent during the time period, which led to the drop in the sectorial index of Blockchain & Cryptocurrency. Regulations imposed on creative media and the inefficiency of some government innovations (e.g. iAM Smart) also contributed to the decrease in the index for the Supporters & Others sector.

About the HKU FinTech Index Series Project

The HKU FinTech Index Series Project introduces the Hong Kong FinTech Growth Index (FGI) and the Hong Kong FinTech Buzz Index (FBI) to gauge local FinTech companies' outlook on the industry and the general sentiment on the sector as reported by local press. It is the first in the region to provide index indicators on the development of the sector, with an aim to provide information in a timely manner to track the growth and development of the financial technology industry in Hong Kong.

FGI is a yearly index with four sub-indices on Business Environment, Business Performance, Investment on R&D and Demand for Talent. It is a forecast of the Hong Kong FinTech sector's market situation in the coming year and an assessment of the situation in the current year. FBI is a quarterly index representing a quantified sentiment of the local FinTech-related news articles in Chinese in the past three months. The index has a base value of 100 points which represents the sentiment of nearly 10K FinTech related news articles in major local news media outlets in 2016 and 2017. FBI is further broken down into six sectors: Insurance Technology (InsurTech), Wealth Management and Credit Technology (WealthTech & CreditTech), Blockchain & Cryptocurrency, E-Payment & Digital Banking, Regulatory Technology (RegTech) & Cybersecurity and other related business including AI and big data.

The project is led by Prof. S.M. Yiu, Professor, Department of Computer Science, HKU, and Prof. Philip Yu, Honorary Professor, Department of Computer Science, HKU; Head & Professor, Department of Mathematics and Information Technology, EdUHK, and funded by The University of Hong Kong - Standard Chartered Hong Kong 150th Anniversary Community Foundation FinTech Academy.

To provide professional insight, the Advisory Board is established, comprising professionals from the University of Hong Kong and the local FinTech industry, including representatives from FinTech Association of Hong Kong, InvestHK, Cyberport, Hong Kong Science and Technology Parks Corporation, and The Bank of East Asia, Limited. The members provide expert advice on the FinTech companies to be included in the master list for the annual survey to return the FinTech Growth Index. They also advise the Project on index methodology.

For further information on the HKU FinTech Index Series Project, please visit the project's website at www.fintechindex.hku.hk.

About The University of Hong Kong - Standard Chartered Hong Kong 150th Anniversary Community Foundation FinTech Academy

The University of Hong Kong - Standard Chartered Hong Kong 150th Anniversary Community Foundation FinTech Academy ("the HKU-SCF FinTech Academy") was established in April 2020 with a mission to make a sustainable impact in FinTech by grooming world-class talents and leading innovative research to further strengthen Hong Kong's position as an international financial centre.

Through a commitment of HK$60 million from the Standard Chartered Hong Kong 150th Anniversary Community Foundation, the HKU-SCF FinTech Academy is steered by the Faculty of Engineering, with support from the Faculty of Law as well as the Faculty of Business & Economics of The University of Hong Kong.

For media enquiry:

Ms Melanie Wan, Communication and Public Affairs Office, HKU (Tel: 2859 2600 / Email: melwkwan@hku.hk),

Prof. S.M. Yiu, Department of Computer Science, HKU (Email: smyiu@cs.hku.hk), or

Prof. Philip L.H. Yu, Department of Computer Science, HKU; Department of Mathematics and Information Technology, EdUHK (Email: plhyu@cs.hku.hk, plhyu@eduhk.hk)