Media

HKU announces 2012 Q4 HK Macroeconomic Forecast

10 Oct 2012

Slower Economic Growth in Hong Kong

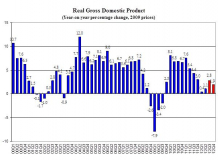

The APEC Studies Programme of the Hong Kong Institute of Economics and Business Strategy at the University of Hong Kong (HKU) released its quarterly Hong Kong Macroeconomic Forecast today (October 10). According to its High Frequency Macroeconomic Forecast, real GDP in 12Q3 is estimated to increase by 2.8% when compared with the same period last year. This is a downward revision of the previous forecast of 3.0% growth released on July 11, 2012, reflecting a weaker external demand. In 12Q4, real GDP growth is forecast to rise by 1.9% when compared with the same period last year.

Professor Richard Wong Yue-Chim, Professor of Economics at HKU said that, "Hong Kong's real GDP in 2012 is estimated to grow by 2.3% in the second half of this year, picking up from the 0.9% increase in the first half. This acceleration in output growth reflects a rebound in the visible trade. For the year as a whole, real GDP is forecast to increase by 1.6%, as compared with the 5.0% growth in 2011. The growth in real GDP is driven by domestic demand, with external demand making a negative contribution. The increase in domestic demand is estimated to account for 3.3 percentage point of the 1.6% overall increase in real GDP in the current year, while the net exports of goods and services is estimated to subtract 1.7 percentage point from overall growth."

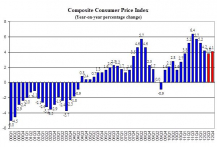

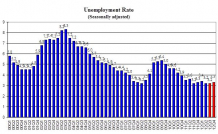

"The labour market is projected to remain relatively stable with the unemployment rate forecast to increase to 3.3% in 12Q4, up from 3.2% in 12Q3. The number of unemployed workers is projected to rise by 4,000, and the number of employed workers is estimated to go up by 3,000 in the current quarter. Inflationary pressure is relatively stable, with the price level, as measured by the composite CPI, estimated to increase to 4.1% in 12Q4," according to Dr. Alan Siu, Executive Director of the Hong Kong Institution of Economics and Business Strategy at HKU.

The forecast details are in Table 1 and Table 2, and the forecasts of selected monthly indicators are in Table 3. All growth rates reported are on a year-on-year basis.

Forecast Highlights

- Given a more uncertain economic outlook, private consumption spending grew by 3.7% in 12Q2, decelerating from the 6.5% growth in 12Q1. The deceleration in the growth of consumption spending will continue. Private consumption spending is projected to grow, but at a slower pace, with a growth rate forecast to be 2.8% in 12Q3 and decelerate to 2.5% in 12Q4. For the year as a whole, private consumption spending is forecast to grow by 3.8%.

- Benefit by the pickup of visitor arrivals during August 2012, the volume of retail sales grew by 3.2%, faster than the 1.4% growth in July 2012. The sharp fall in spending on jewellery, watches and valuable gifts will continue to put a downward pressure on the growth of retail sales. The growth of the volume of retail sales is expected to moderate to 3.8% in 12Q3 and 3.3% in 12Q4. For the 2012 as a whole, it is projected to grow by 6.3%.

- Exports of goods dropped by 0.4% in 12Q2, a sound improvement from the 5.7% decline in 12Q1. With the confirmation of supportive accommodative policies by the Fed, the export growth is expected to resume in the second half of this year. The growth of the exports of goods is estimated to be 2.0% in 12Q3, and picking up to 3.9% in the current quarter. For the year as whole, total exports of goods is forecast to have zero growth in 2012.

- Imports of goods increased by 0.7% in 12Q2, reverted from the 2.7% drop in 12Q1. In tandem with the pickup in the exports of goods, imports of goods is forecast to grow by 2.7% in 12Q3 and to rise by 5.2% in 12Q4. For the year as a whole, it is projected to grow by 1.6%.

- Service exports grew by 2.1% in 12Q2, decelerating from the 2.9% growth in 12Q1. Along with the visitor arrivals growth of 20.5% in August and resumption of growth in visible trade, service exports is expected to improve further. It is forecast to grow by 3.9% in 12Q3 and picking up to 5.0% in 12Q4. For the year as whole, total exports of services is forecast to increase by 3.5% in 2012.

- Service imports went up by 1.5% in 12Q2, decelerating from the 3.5% growth in 12Q1. Service imports is forecast to grow by 0.7% and 2.8% in 12Q3 and 12Q4 respectively. It is estimated to grow by 2.1% in the whole year of 2012.

- Gross fixed capital formation grew by 5.7% in 12Q2, slowing down from the 12.9% growth in 12Q1. Infrastructural projects will continue to provide impetus for investment spending. The gross fixed capital formation is projected to grow by 5.4% in 12Q3 and 4.2% in 12Q4. The annual growth is estimated to be 6.8%.

- Investment in land and construction went up by 5.7% in 12Q2. The infrastructural projects will continually provide growth momentum, with the growth rate projected to be 1.1% in 12Q3 and to 0.4% in 12Q4. The annual growth of 2012 is estimated to be 2.5%.

- Investment spending in machinery, equipment and computer software increased by 5.7% in the 12Q2. Underpinned by the low interest environment, investment in machinery, equipment and computer software is projected to increase by 8.3% in 12Q3 but moderated to 6.9% growth in 12Q4 when compared with the same period last year. It is projected to increase by 10.1% for the year of 2012 as a whole.

- The general price level, as measured by the Composite CPI, rose by 3.8% in August 2012. The headline consumer inflation rate was 4.2% in 12Q2. If there were no fiscal measures, the underlying rate would have been 5.1% in 12Q2. Inflationary pressure is projected to ease further, given the decelerating growth in food and rental prices. The inflation rate is forecast to be 3.8% in 12Q3 and increase to 4.1% in 12Q4. For the year as a whole, the headline consumer inflation is estimated to be 4.3% for the year of 2012, as compared to the 5.3% in 2011.

- The provisional seasonally adjusted unemployment rate remained at 3.2% in the 3 months ending in August 2012. Hong Kong's labour force reached an all-time-high level of 3.8 million persons in 12Q3. The unemployment rate is forecast to be 3.2% in 12Q3, and to rise slightly to 3.3% in 12Q4. The labour force is estimated to increase by 7,000 persons with the number of jobs increased only by 3,000, resulting in the number of unemployed going up by 4,000 persons. For the year of 2012 as a whole, the unemployment rate is estimated to average out to be 3.3%.

Concluding Remarks

Despite a challenging global environment due to the sovereign debt crisis in Europe and anemic economic recovery in the United States, the Hong Kong economy still managed to grow by 5% last year, down from the 7.0% growth in 2010. In our press release in January this year, the global economy was projected to continue to slow further, with Hong Kong's real GDP growing by 2% to 3%. It turns out that the global economy is weaker than the estimate at the beginning of the year. Our real GDP is now revised to grow by only 1.6% in 2012.

About Hong Kong Macroeconomic Forecast Project

The Hong Kong Macroeconomic Forecast is based on research conducted by the APEC Studies Programme of the Hong Kong Institute of Economics and Business Strategy at HKU in the Faculty of Business and Economics. It aims to provide the community with timely information useful for tracking the short-term fluctuations of the economy. The current quarter marco forecasts have been released on a quarterly basis since 1999.

The high frequency forecasting system was originally developed in collaboration with Professor Lawrence Klein of the University of Pennsylvania in 1999-2000. Since then, the system has been maintained and further refined by the APEC Study Center which is now a research programme area of the Hong Kong Institution of Economics and Business Strategy.

The project is sponsored by the Faculty of Business and Economics. The Hong Kong Centre for Economic Research at HKU provides administrative support to the project. Researchers at the Hong Kong Institution of Economics and Business Strategy are solely responsible for the accuracy and interpretation of the forecasts. Our quarterly forecasts can be accessed at: http://www.hiebs.hku.hk/apec/macroforecast.htm

For media enquiries, please contact Ms Trinni Choy, Assistant Director (Media) (Tel: 2859 2606/Email: pychoy@hku.hk ), or Ms Melanie Wan, Manager (Media) (Tel: 2859 2600/Email: melwkwan@hku.hk ), Communications & Public Affairs Office, HKU.