Media

HKU FinTech Indices reveal a positive outlook for 2020-21 despite negative impact from COVID-19 and protests

30 Jun 2020

The HKU FinTech Index Series Project published the second-year Hong Kong FinTech Growth Index (FGI) and the 2020Q1 Hong Kong FinTech Buzz Index (FBI) to gauge local FinTech companies’ outlook and the general sentiment on the sector as reported by the local press.

Hong Kong FinTech Growth Index 2020

The FGI represents responses to an annual survey by 27 companies, 11 less than last year.

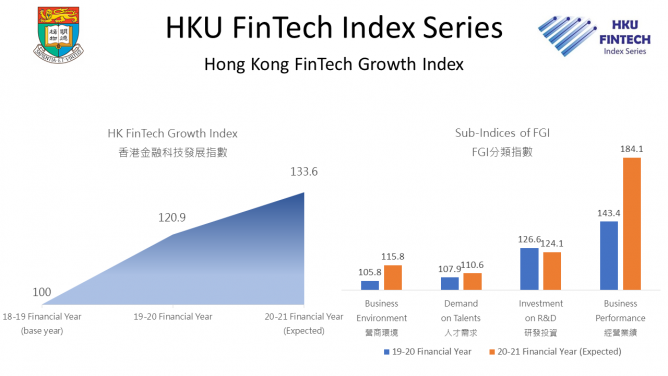

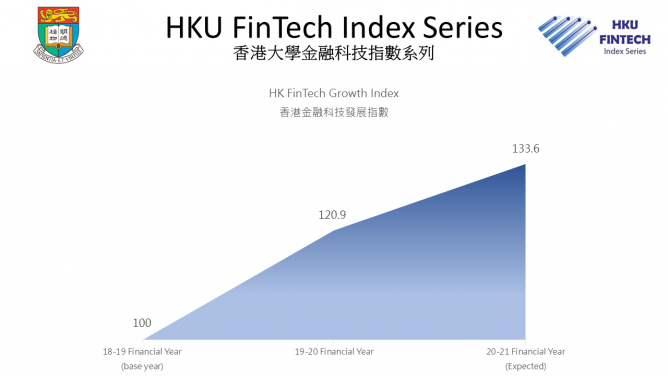

The Hong Kong FGI for the financial year 2019-20 is 120.9, up 20.9 index points from 2018-19. The FGI expected for the financial year 2020-21 is 133.6, an increase of 12.7 index points (or 10.5%), representing a positive outlook for Fintech development in Hong Kong in the coming year despite the impact from the anti-extradition bill protests and COVID-19 outbreak.

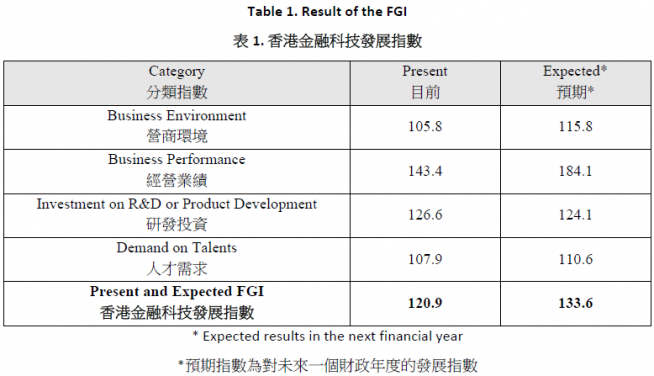

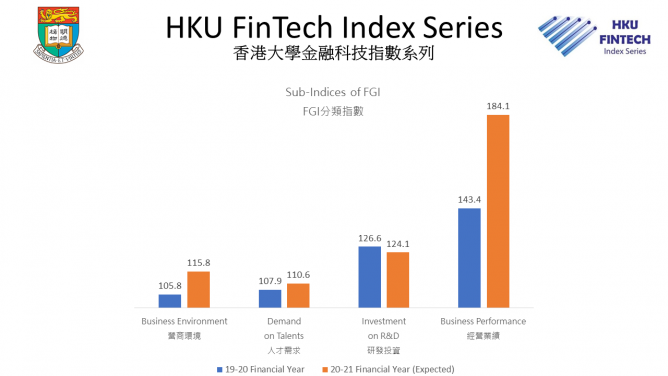

Of the four sub-indices (Table 1), the Business Environment sub-index, measured by both internal and external factors on FinTech business operations and development, is 105.8, 5.8% higher than 2018-19. The sub-index is expected to increase by 9% to 115.8 in 2020-21, attributing to improvement in external factors including more funding opportunities and a safer and more stable investment environment in the coming year.

The Business Performance sub-index, measured by FinTech customer adoption rate and revenue, is 143.4, 43.4% higher than 2018-19, and is expected to increase by 28.4% to 184.1 in 2020-21, representing a positive outlook in business development by the FinTech industry. Of the companies that responded, 70.4% mentioned talents acquisition as the main challenge in business operation which has become more difficult.

The Investment on R&D or Product Development sub-index is 126.6 for 2019-20, 26.6% higher than 2018-19 and is expected to drop by 2% to 124.1 in 2020-21. The downturn can be attributed to FinTech companies lowering their investment on R&D or product development. In 2019-20, FinTech companies mainly spent their R&D or product development expenditure on Customer experience (59.3%), AI, big data and machines/deep learning (44.4%) and Mobile solutions (33.3%).

The Demands on Talents sub-index is 107.9, 7.9% higher than 2018-19 and is expected to increase by 3% to 110.6 in 2020-21. The expected growth rate is lower than sub-indices Business Environment and Performance which indicates that companies are turning conservative in hiring talents due to the downside revenue risk. On the required skills for new employees, programming skills (85.2%) is the most preferred skills by employers, followed by marketing expertise (48.1%). IT infrastructure skills (42.1%) have evolved to be a more important skill set than in 2018-19.

Hong Kong FinTech Buzz Index – 2020Q1

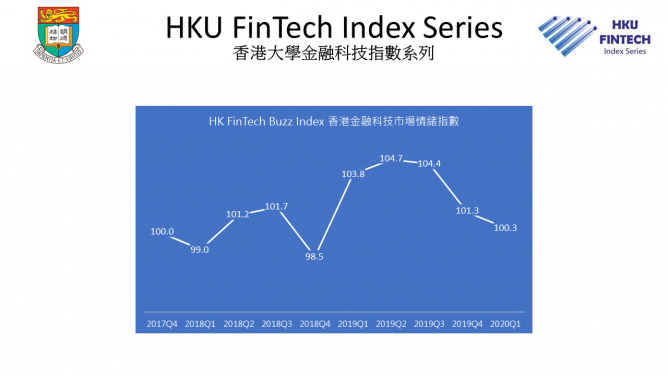

Around 1,000 news articles in the first three months from January to March 2020 were analysed. Hong Kong FBI for the first quarter (Q1) of 2020 is 100.3, a drop of 1 index point (or 0.98%) from 101.3 in the last quarter of 2019 (2019Q4). The YoY change drops by 3.5 index points, or a 3.37% decrease from 103.8 in 2019Q1, continuing a downward trend from the peak in 2019Q2.

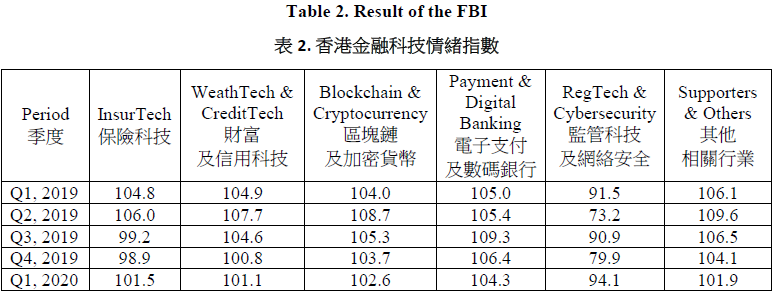

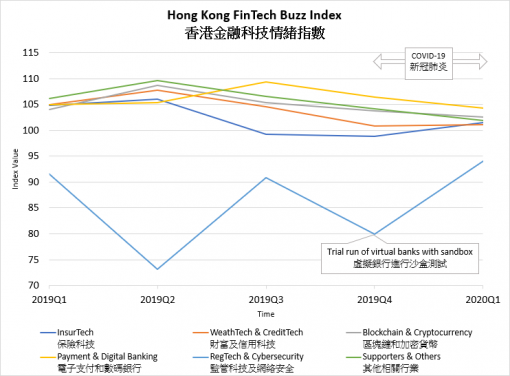

Indices of the six subsectors show different changes (Table 2), with increases recorded in three sub-indices: Insurance Technology (InsurTech), Wealth Technology and Credit Technology (WealthTech & CreditTech), and Regulatory Technology (RegTech) & Cybersecurity. Positive news in InsurTech were related to banks in Hong Kong switching to promote online insurance under COVID-19 which has facilitated the growth of related technology. Moreover, the launch of virtual banks has proved the successful use of sandbox to ensure cybersecurity, hence resulting in positive news in RegTech & Cybersecurity as well as WealthTech & CreditTech.

The reasons underlying the overall drop in FBI for 2019-20 are complicated. Hong Kong has experienced the outbreak of Covid-19 during the period, some FinTech companies might have been closed temporarily as a social-distancing measure, which may slow the pace of financial technology development.

About the HKU FinTech Index Series Project

The HKU FinTech Index Series Project introduces the Hong Kong FinTech Growth Index (FGI) and the Hong Kong FinTech Buzz Index (FBI) to gauge local FinTech companies' outlook on the industry and the general sentiment on the sector as reported by local press. It is the first in the region to provide index indicators on the development of the sector, with an aim to provide information in a timely manner to track the growth and development of the financial technology industry in Hong Kong.

FGI is a yearly index with four sub-indices on Business Environment, Business Performance, Investment on R&D and Demand on Talent. It reflects Hong Kong FinTech sector's forecast of the market situation in the coming year and gives an assessment of the situation in the current year. FBI is a quarterly index representing a quantified sentiment of the local FinTech-related news articles in Chinese in the past three months. The index has a base value of 100 points which represents the sentiment of nearly 10K FinTech related news articles in major local news media outlets in 2016 and 2017. FBI is further broken down into six sectors: Insurance Technology (InsurTech), Wealth Management and Credit Technology (WealthTech & CreditTech), Blockchain & Cryptocurrency, E-Payment & Digital Banking, Regulatory Technology (RegTech) & Cybersecurity and other related business including AI and big data.

The project was initiated by the technology transfer company of the University - Versitech Limited, and is led by Dr Philip Yu of the Department of Statistics and Actuarial Science of the Faculty of Science. The five-year project is sponsored by Suoxinda Data Technology Co. Ltd headquartered in Shenzhen.

About HKU FinTech Index Advisory Board

The Advisory Board comprises professionals from the University of Hong Kong and the local FinTech industry, including representatives from FinTech Association of Hong Kong, InvestHK, Cyberport, Hong Kong Science and Technology Parks Corporation, The Bank of East Asia, Limited, and Suoxinda Data Technology Co. Ltd. The members provide expert advice on the FinTech companies to be included in the master list for the annual survey to return the FinTech Growth Index. They also advise the Project on index methodology.

For further information on the HKU FinTech Index Series Project, please visit the project's website at www.fintechindex.hku.hk.

For media enquiry:

Ms Melanie Wan, Communication and Public Affairs Office, HKU (Tel: 2859 2600 / Email: melwkwan@hku.hk), or

Dr Philip L.H. Yu, Department of Statistics and Actuarial Science, Faculty of Science, HKU (Email: plhyu@hku.hk)