Media

HKU announces 2014 Q4 HK Macroeconomic Forecast

08 Oct 2014

Hong Kong Economic Outlook

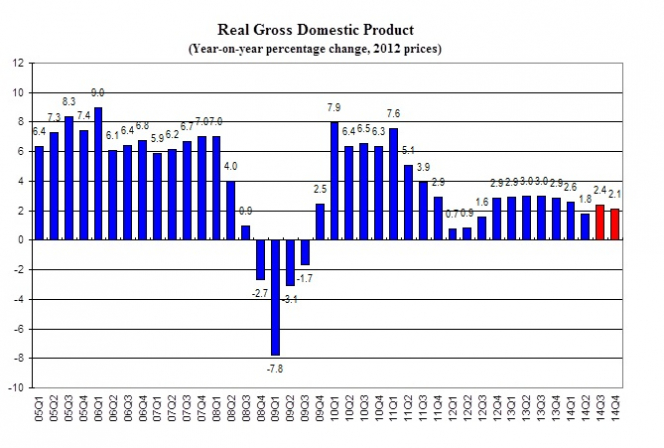

The APEC Studies Programme of the Hong Kong Institute of Economics and Business Strategy at the University of Hong Kong (HKU) released its quarterly Hong Kong Macroeconomic Forecast today (October 8). According to its High Frequency Macroeconomic Forecast, real GDP in 14Q3 is estimated to grow by 2.4% when compared with the same period last year. This is a downward revision from the previous forecast release of 3.7%. This revision mainly reflects the weaker-then-expected external demand for exports of services and the weaker-than-expected local demand. In 14Q4, real GDP growth is forecast to be 2.1% when compared with the same period last year.

Professor Richard Wong Yue-Chim, Professor of Economics at HKU said that, "US economy came back on track with a strong second quarter rebound of 4.6%. Under the low interest rate environment and sustained economic growth in China, Hong Kong’s economy is expected to grow but at a modest rate. Hong Kong’s real GDP is estimated to grow by 2.2% in the second half of this year, same as the first half. Thus, the real GDP is forecast to increase by 2.2% for the year of 2014 as a whole. The growth in real GDP continues to be driven primarily by domestic demand. The increase in domestic demand is estimated to account for 1.8 percentage points of the overall increase in real GDP in the current year, while the external demand contributed 0.4 percentage point.”

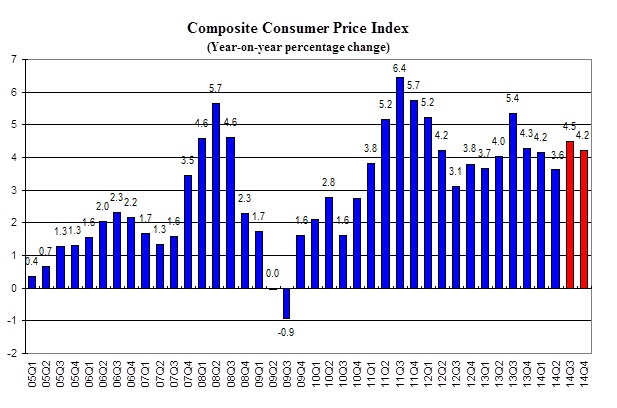

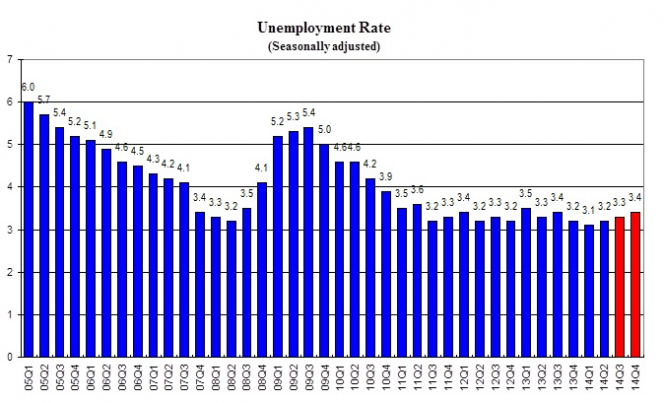

"The labour market is expected to worsen slightly with the unemployment rate projected to be 3.4% in 14Q4 as compared to 3.3% in 14Q3. Inflation is expected to be stable in the near term. The headline consumer inflation rate is forecast to be 4.2% in 14Q4, down from the estimated 4.5% in 14Q3," according to Dr. Wong Ka-fu, Principal Lecturer of Economics at HKU.

The forecast details are in Table 1 and Table 2, and the forecasts of selected monthly indicators are in Table 3. All growth rates reported are on a year-on-year basis.

Forecast Highlights

- Dampened by cautious consumer spending, private consumption is projected to grow in the current quarter at 1.7%, slightly lower than the 2.0% increase in the 14Q3. For the year as a whole, private consumption spending is forecast to grow by 1.6%.

- The volume of retail sales grew by 2.8% in August 2014, reverting from the consecutive weakness in the past six months since February 2014. Given the reduction of visitors’ spending and weaker performance of domestic demand, retail sales is projected to be weak in the current quarter. The drop in the volume of retail sales is estimated to be 0.6% in 14Q3, a short-term rebound from the 7.3% drop in 14Q2. In 14Q4, we forecast retail sales to worsen again to fall by 2.0%. For the year of 2014 as a whole, it is projected to fall by 1.2%.

- Total exports of goods increased by 2.3% in 14Q2, up from the 0.5% growth in 14Q1. In August 2014, the exports of goods from Hong Kong grew by 6.4% in nominal terms. Given the economic recovery in the developed countries, the growth of exports of goods in real terms is estimated to be 2.2% in both 14Q3 and 14Q4, reflecting a rather stable external demand. For year 2014 as a whole, total exports of goods is forecast to increase by 1.8%.

- Imports of goods increased by 1.1% in 14Q2, decelerating slightly from the 1.2% growth in 14Q1. In tandem with the growth in exports of goods, imports of goods grew by 3.4% in August 2014 in nominal terms. The growth of imports of goods in real terms is forecast to increase by 1.5% in 14Q3 and 1.7% in 14Q4. For the year as a whole, it is projected to grow by 1.4%.

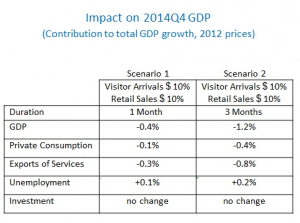

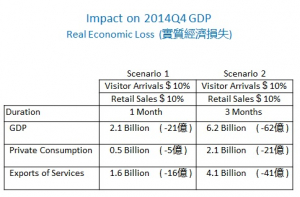

- Service exports had taken a U-turn to drop by 2.3% in 14Q2, reverting from the 3.3% growth in 14Q1. This drop is mainly attributed to the 11.5% drop in travel related services in 14Q2. Indeed, the travel related services accounted for about 35% of the total service exports. This drop is partly due to the higher base of comparison, in which many Mainland visitors came for gold purchases in the same period of the previous year. Growth in service exports is expected to be resumed as visitor arrivals grew at 12.2% in August 2014. Service exports is forecast to be 1.0% in 14Q3 and 2.7% in 14Q4. The annual growth is estimated to be 1.2%. We are cautious that the recent tension of the prolonged protest could lead to further deterioration to the tourism industry. The impact will depend on the duration of the protest and the duration of travel warnings from other countries.

- Service imports increased by 5.0% in 14Q2, reverted from the 0.8% drop in 14Q1. Growth in service imports is forecast to moderate to 3.8% in 14Q3 and 2.5% in 14Q4. It is estimated to grow by 2.6% in the whole year of 2014.

- Gross fixed capital formation dropped by 5.6% in 14Q2, reverting from the 3.5% growth in 14Q2. Due to lack of commencement of infrastructural projects, slowdown in investment spending is expected. The gross fixed capital formation is projected to shrink by 3.2% in 14Q3 and 7.0% in 14Q4. For the year of 2014 as a whole, it is estimated to fall by 3.4%.

- Investment in land and construction grew by 1.4% in 14Q2, slowed from the 5.0% growth in 14Q1. In conjunction with lack of new infrastructural projects and timid growth in private construction, investment in land and construction is expected to remain subdued for the rest of this year, with the decline projected to be 4.1% and 0.6% in 14Q3 and 14Q4 respectively. For the year of 2014 as a whole, it is estimated to grow by 0.5%.

- Investment spending in machinery, equipment and computer software plunged by 10.0% in 14Q2. Investment in machinery, equipment and computer software is projected to remain weak. We forecast it to drop by 2.5% in 14Q3 and 11.5% in 14Q4 when compared with the same period last year. It is projected to drop by 6.3% for the year of 2014 as a whole.

- The general price level, as measured by the Composite CPI, rose by 3.9% in August 2014. The headline consumer inflation rate is estimated to be 4.5% in 14Q3 and after stripping out of government measures (i.e., government rental waiver and electricity subsidy) implemented last year, the rate would only be 3.3% in the third quarter. The consumer inflation rate is forecast to be 4.2% in the current quarter, with underlying rate at 3.4% after netting out of the impact of ending the rates concession. For year 2014 as a whole, the headline inflation is estimated to be 4.1%, only a slight decrease as compared to the 4.3% inflation in 2013.

- The provisional seasonally adjusted unemployment rate stood at 3.3% in the 3 months ending in August 2014, reflecting tight labour market. Clouded by uncertainties, the number of jobs is estimated to decrease by 11,000 and the number of unemployed workers to rise by 5,000 in 14Q4 comparing with previous quarter. The unemployment rate is forecast to worsen to 3.3% in 14Q3 and 3.4% 14Q4. For the year of 2014 as a whole, the unemployment rate is estimated to average out to be 3.3%.

Concluding Remarks

We lower our forecast of annual growth of real GDP to 2.2% in 2014, as opposed to the 3.4% announced earlier. This revision mainly reflects the weaker-than-expected and uncertain external development: slower-than-expected recovery of the US economy, the uncertainty of rising interest rate in the US, the unstable recovery of the European Union, as well as the slightly weaker performance of mainland China.

The increasing likelihood of rising interest rate in the US will continue to cloud the economic growth in Hong Kong, via consumer spending and investment slowdown in Hong Kong by the end of 2014. Indeed, the 4.6% growth in 14Q2 US GDP and the unexpected drop in US unemployment rate at 5.9% in 14Q3 induced the expectation of rising interest rate.

The recent street protest in Hong Kong will certainly restrain Hong Kong’s economic growth by reducing the local consumption demand, the demand for services by visitors, and the investment demand. The extent of the impact depends critically on the duration of the protest and the response from various parties and is difficult to tell at this time. We certainly hope that the protest will end soon and business will return to normal. Nevertheless, if our experience of SARS is of any guide, the impact on economic growth of a short-lived protest will likely be small and short-lived.

About Hong Kong Macroeconomic Forecast Project

The Hong Kong Macroeconomic Forecast is based on research conducted by the APEC Studies Programme of the Hong Kong Institute of Economics and Business Strategy at HKU in the Faculty of Business and Economics. It aims to provide the community with timely information useful for tracking the short-term fluctuations of the economy. The current quarter macro forecasts have been released on a quarterly basis since 1999.

The high frequency forecasting system was originally developed in collaboration with Professor Lawrence Klein of the University of Pennsylvania in 1999-2000. Since then, the system has been maintained and further refined by the APEC Study Center which is now a research programme area of the Hong Kong Institution of Economics and Business Strategy.

The project is sponsored by the Faculty of Business and Economics. The Hong Kong Centre for Economic Research at HKU provides administrative support to the project. Researchers at the Hong Kong Institution of Economics and Business Strategy are solely responsible for the accuracy and interpretation of the forecasts. Our quarterly forecasts can be accessed at: http://www.hiebs.hku.hk/apec/macroforecast.htm

For media enquiries, please contact HKU Communications & Public Affairs Office

Ms Trinni Choy, Assistant Director (Media) (Tel: 2859 2606/Email: pychoy@hku.hk), or Ms Melanie Wan, Senior Manager (Media) (Tel: 2859 2600/Email: melwkwan@hku.hk).