Media

HKU Announced 2009 Q1 HK Macroeconomic Forecast

07 Jan 2009

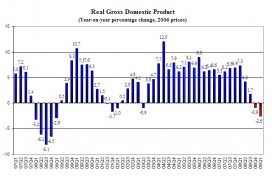

Recession in Hong Kong deepened in 2008 Q4

The APEC Study Center of the University of Hong Kong (HKU) released its quarterly Hong Kong Macroeconomic Forecast today (January 7). According to its High Frequency Macroeconomic Forecast, real GDP in Q4 of 2008 is estimated to shrink by 0.9% on a year-on-year basis. This update is a downward revision of the 2.6% growth forecast released on October 8, 2008. The sharp downturn of Hong Kong since October last year was due to the severe credit crunch as a consequence of the global financial crisis. Both external and domestic demand will continue to be weak, deepening the recession. In the first quarter of 2009, real GDP is forecast to drop further by 2.6% when compared with the same period last year.

Professor Richard Wong Yue-Chim, Professor of Economics at HKU said that, "Despite the turmoil in the financial markets, due to the robust performance in the first half of last year, Hong Kong's economy was still growing last year. The growth rate as a whole is estimated to be 2.9% in 2008, which is a sharp slowdown from the 6.4% growth in 2007. Private consumption spending and net exports were the primary growth drivers, accounting for 1.4 and 1.2 percentage points of the overall growth of 2008 respectively. 2009 will be a difficult year for the global economy, with all the developed economies projected to contract together. The credit crunch has brought havoc to the global economy. Given such a weak global environment, Hong Kong's real GDP is forecast to contract by 2.6% in the current quarter."

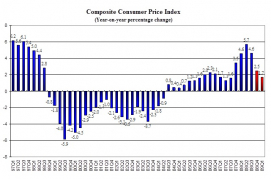

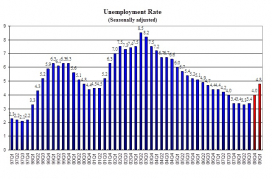

According to Dr. Alan Siu, Director of the APEC Study Center at HKU, "The unemployment rate is forecast to shoot up to 4.8% in the current quarter from the 4.0% estimate in the last quarter. The deterioration in the job markets and the sharp downturn in asset markets have hurt consumer confidence, ending 5 consecutive years of growth in private consumption spending. Weak demand, falling oil prices and the current strength of the US dollar will pull down prices, with the headline inflation rate forecast to decelerate to 1.7% in the current quarter. Excluding fiscal measures, the year-on-year percentage change in the consumer price level will be higher at 3.0%,"

The forecast details are in Table 1 and Table 2, and the forecasts of selected monthly indicators are in Table 3. All growth rates reported are on a year-on-year basis.

Forecast Highlights

- Private consumption spending rose only by 0.2% in Q3 of 2008, sharply down from the 3.2% growth in Q2 of 2008. Rising unemployment, falling asset prices and a much weaker global economic environment have hurt consumer confidence further. Private consumption expenditure is estimated to shrink by 1.3% in Q4 of 2008 and to contract by 2.3% in the current quarter. Taking account of the robust growth in the first half of 2008, it is estimated to grow by 2.4% in 2008.

- The volume of retail sales in November 2008 registered a decrease of 2.8% when compared with the same period last year. The retail sales volume of consumer durables, jewellery and food dropped by 9.5%, 3.7% and 2.1%, respectively. The volume of retail sales is forecast to decrease by 3.5% in Q4 of 2008 and 3.2% in Q1 of 2009. For 2008 as a whole, it is estimated to grow by 4.7%.

- Total exports of goods grew by 1.4% in Q3, down from the 4.4% growth in Q2. The growth in total exports of goods is estimated to be 0.3% in Q4 of 2008 and 3.4% for 2008 as a whole. Given the credit crunch and projected global slowdown, total exports of goods is forecast to drop by 1.8% in Q1 of 2009.

- Service exports grew by 5.3% in Q3 of 2008. The number of visitor arrivals dropped by 1.1% in November 2008, when compared with the same period in 2007. The export of trade-related services will decrease as a consequence of contraction in the exports of goods. Service exports growth is estimated to have slowed to 4.2% in Q4 of 2008 and 6.8% for the year of 2008. The growth in Q1 of 2009 is forecast to be 3.0%.

- The imports of goods grew by 2.2% in Q3 of 2008. Reflecting a weakening in external demand, the growth of imports of goods is forecast to fall by 0.3% in Q4 of 2008. For the year of 2008, the growth is projected to be 3.6%. The imports of goods is forecast to fall by 1.2% in the current quarter.

- Import of services increased by 1.8% in Q3 of 2008. Service imports is forecast to grow by 1.6% in Q4 of 2008 and 4.1% for the year of 2008 as a whole. It is estimated to grow by 0.6% in Q1 of 2009.

- The trade balance, as measured by the net exports of goods and services in real terms, is estimated to be 13.8% of GDP in Q3 of 2008. It is forecast to be 13.5% of GDP in Q4 of 2008, 11.1% of GDP for the year of 2008 and is forecast to be 10.9% of GDP in Q1 of 2009.

- Gross fixed capital formation rose by 3.0% in Q3 of 2008. Uncertain economic outlook and tight credit market conditions will slow down the investment in fixed capital. Gross fixed capital formation is estimated to drop by 1.3% in Q4 of 2008 but grew by 3.6% for the year of 2008 as a whole. It is forecast to fall by 4.7% in Q1 of 2009.

- Investment in land and construction decreased by 8.3% in Q3 of 2008. It is estimated to decline by 6.8% in Q4 of 2008 and by 0.2% for the year as a whole of 2008. The decrease in the current quarter is forecast to be 9.6%.

- Investment spending in machinery, equipment and computer software rose by 9.9% in Q3 of 2008. Given the uncertain business outlook, machinery and equipment investment growth is estimated to moderate to a 2.0% growth in Q4 of 2008 and 6.0% for the year of 2008 as a whole. In the current quarter, it is forecast to fall by 1.0% when compared with the same period last year.

- Inflation, as measured by the year-on-year percentage change of the Composite CPI, was 3.1% in November 2008. Most of the increase was accounted for by the 2.6 percentage points increase in food prices. Lower consumer confidence and significant drop in energy prices eased the inflationary pressure. With the government relief measures, the headline consumer inflation rate is estimated to drop to 2.5% in the Q4 of 2008 and 4.3% for the year 2008 as a whole. In the current quarter, it is forecast to be 1.7%, reflecting the dis-inflationary process.

- The provisional seasonally adjusted unemployment rate worsened from 3.5% in the three months average ending in October 2008 to 3.8% for the three months ending in November 2008. The median of duration of unemployment rose to 72 days in Q3 of 2008 from 67 days in Q2 of 2008, reflecting a softening in the job market which is projected to worsen. The unemployment rate is forecast to be 4.0% in Q4 of 2008, and is projected to rise to 4.8% in the current quarter.

Concluding Remarks

Following the financial turmoil last year, 2009 will be a difficult year for the global economy, with all the developed economies projected to contract together for the first time since the Second World War. As a small open economy, Hong Kong cannot escape the adverse economic conditions. The recession in Hong Kong will get worse in the current quarter, with prices falling and unemployment rising. The global economy is expected to stabilize by year end, given all the huge fiscal stimulus packages in the world.

About Hong Kong Macroeconomic Forecast Project

The Hong Kong Macroeconomic Forecast is based on research conducted by the APEC Study Center of the HKU's Faculty of Business and Economics. It aims to provide the community with timely information useful for tracking the short-term fluctuations of the economy. The current quarter marco forecasts have been released on a quarterly basis since 1999.

The high frequency forecasting system was originally developed in collaboration with Professor Lawrence Klein of the University of Pennsylvania in 1999-2000. Since then, the system has been maintained and further refined by the HKU APEC Study Center.

The project is sponsored by the Faculty of Business and Economics. The Hong Kong Centre for Economic Research at HKU provides administrative support to the project. Researchers at the APEC Study Center are solely responsible for the accuracy and interpretation of the forecasts. Our quarterly forecasts can be accessed at http://www.hiebs.hku.hk/apec/macroforecasts

For media enquiries, please contact Ms. Joanne Yung, Manager (Media), External Relations Office, HKU (Tel: 2859 2600 / Email: hkumedia@hku.hk ).