Media

HKU announces 2013 Q2 HK Macroeconomic Forecast

09 Apr 2013

.Economic Outlook

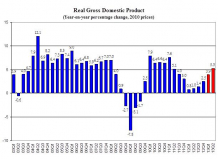

The APEC Studies Programme of the Hong Kong Institute of Economics and Business Strategy at the University of Hong Kong (HKU) released its quarterly Hong Kong Macroeconomic Forecast today (April 9). According to its High Frequency Macroeconomic Forecast, real GDP in 13Q1 is estimated to increase by 3.9% when compared with the same period last year. This is an upward revision of our previous forecast of 2.9% growth released in January 3, 2013, reflecting a strong pickup in domestic demand. In 13Q2, real GDP growth is forecast to rise by 5.3% when compared with the same period last year.

Professor Richard Wong Yue-Chim, Professor of Economics at HKU said that, "Hong Kong underwent a below trend rate of growth in 2012 due to the European sovereign debt crisis, with real GDP growing by 1.4% last year, slowdown from the 4.9% growth in 2011. The negative impact seems stabilized. The strong growth in the Mainland provides the underpinning of sustained growth in the local economy. Low interest rates, vibrant consumer sentiment and continuity of infrastructural projects will continue to support Hong Kong economic growth in 2013. The pace of Hong Kong's real GDP growth is forecast to accelerate and grow by 4.6% in the first half of 2013, up from the 2.0% growth in the second half in 2012. This pickup is mainly contributed by domestic demand."

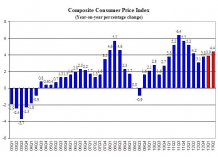

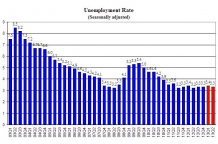

"The job market is projected to improve slightly with the unemployment rate forecast to edge down to 3.3% in 13Q2 from the estimated 3.4% in 13Q1. Inflation is expected to rise in the near term, fueled by increasing food prices, as well as rising rental rates. The headline consumer inflation rate is forecast to rise to 4.4% in the second quarter, up from the estimated 3.9% in the first quarter," according to Dr. Ka-fu Wong, Assistant Professor of Economics at HKU.

The forecast details are in Table 1 and Table 2, and the forecasts of selected monthly indicators are in Table 3. All growth rates reported are on a year-on-year basis.

Forecast Highlights

- Given strong economic growth, stable job market and buoyant consumer sentiment, private consumption spending is projected to continue to grow robustly, with a growth rate forecast to be 4.5% in 13Q1 and 4.8% in 13Q2. The pickup in consumption growth is due to the projected momentum gain in output growth in the second quarter.

- The volume of retail sales grew by 10.4% in January 2013 and 21.9% in February 2013, and is projected to continue to grow in the next couple of months, supported by robust local demand, as well as the continued strong growth in visitor arrivals. It is forecast to grow by 14.5% in 13Q1 and by 15.7% in 13Q2.

- Total exports of goods in real terms grew by 6.1% in real terms in 12Q4, accelerating from the 4.0% increase in 12Q3. The growth momentum is projected to pick up. Comparing the latest three months ending in February 2013 with same period last year, the nominal exports of goods registered 5.2% growth. The total exports of goods in real terms is estimated to grow by 6.3% in 13Q1 and 7.3% in 13Q2.

- Imports of goods increased by 7.2% in 12Q4, accelerating from the 4.3% growth in 12Q3. In tandem with export growth, the imports of goods also grew by 5.2% in the latest three months ending in February 2013, comparing with same period last year. Given the projected robust growth in private consumption spending, the retained imports will remain strong. The imports of goods is forecast to increase by 7.5% and 8.5% in 13Q1 and 13Q2 respectively.

- Service exports grew by 1.3% in 12Q4, reverted from the 0.6% drop in 12Q3. The pickup in visible trade boosted the demand for trade-related services. The strong growth in visitor arrivals also provided further support for the growth of service exports, the visitors from the Mainland rose by 23.3% in the first two months of 2013. For every 4 visitors, there were around 3 persons coming from Mainland. The increase in service exports is forecast to accelerate to 4.2% in 13Q1 and further to 5.5% in 13Q2.

- Service imports dropped by 0.5% in 12Q4, around the same as 0.6% drop in 12Q3. It is forecast to grow by 0.9% and 0.4% in 13Q1 and 13Q2 respectively.

- Gross fixed capital formation rose by 10.5% in 12Q4, picking up from the 8.3% growth in 12Q3. Projected economic growth and infrastructural projects will continue to uphold investment spending. Gross fixed capital formation is forecast to grow by 7.9% in 13Q1 and 12.0% in 13Q2.

- Investment in land and construction went up by 12.3% in 12Q4. The ongoing infrastructural projects will provide support for steady growth, with the growth rate projected to be 7.1% in 13Q1 and 7.8% in 13Q2.

- Investment spending in machinery, equipment and computer software grew by 9.1% in the 12Q4. Underpinned by the continued economic growth and optimistic business confidence, investment in machinery, equipment and computer software is projected to increase by 8.6% in 13Q1 and 15.3% in 13Q2 when compared with the same period last year.

- The general price level, as measured by the composite CPI, rose by 4.4% in February 2013, with food and housing contributed 1.4 and 1.8 percentage points respectively to the overall increase. These two items accounted for 73% of the total increase in the general price level. Inflationary pressure is expected to remain in the first half of 2013. Given that various government’s relief measures continues, the headline consumer inflation rate is forecast to be 3.9% in 13Q1 and increase to 4.4% in 13Q2.

- The provisional seasonally adjusted unemployment rate stood at 3.4% in the three months ending in February 2013. The job market is expected to continue to be stable. Optimistic business confidence and rising labour income encourage individuals joining the labour force. In 13Q2, the 19,000 increase in the number of employment is expected to outweigh the negative impact of the 4,000 increase in the number of unemployment. The unemployment rate is forecast to be 3.4% in 13Q1, and to fall to 3.3% in 13Q2.

Concluding Remarks

We are optimistic about the economic conditions of Hong Kong. World-wide low interest rate continues to provide stimulus to us, as well as to our trading partners. The robust economic growth in the Mainland and our regional trading partners serve us well. Being a close partner with the Mainland, through CEPA and various agreements, we will continuously benefit from the closer ties between the Mainland and Taiwan, the gradual liberalization of financial services in RMB, and the world’s interest in trading and investing in Mainland China. All these favorable factors, plus the commitment of various infrastructural projects by the Hong Kong government, shield us from the negative impacts from the occasional scare of the EU debt crisis.

Meanwhile, we will watch closely the current tensions on the Korea Peninsula, the threat of bird flu epidemic, the potential economic instability due to the rapid depreciation of Japanese Yen, the development of EU debt crisis, and the recovery of the US economy.

About Hong Kong Macroeconomic Forecast Project

The Hong Kong Macroeconomic Forecast is based on research conducted by the APEC Studies Programme of the Hong Kong Institute of Economics and Business Strategy at HKU in the Faculty of Business and Economics. It aims to provide the community with timely information useful for tracking the short-term fluctuations of the economy. The current quarter marco forecasts have been released on a quarterly basis since 1999.

The high frequency forecasting system was originally developed in collaboration with Professor Lawrence Klein of the University of Pennsylvania in 1999-2000. Since then, the system has been maintained and further refined by the APEC Study Center which is now a research programme area of the Hong Kong Institution of Economics and Business Strategy.

The project is sponsored by the Faculty of Business and Economics. The Hong Kong Centre for Economic Research at HKU provides administrative support to the project. Researchers at the Hong Kong Institution of Economics and Business Strategy are solely responsible for the accuracy and interpretation of the forecasts. Our quarterly forecasts can be accessed at:

http://www.hiebs.hku.hk/apec/macroforecast.htm

For media enquiries, please contact Ms Trinni Choy, Assistant Director (Media) (Tel: 2859 2606/Email: pychoy@hku.hk ), or Ms Melanie Wan, Senior Manager (Media) (Tel: 2859 2600/Email: melwkwan@hku.hk ), Communications & Public Affairs Office, HKU.