Media

HKU announces 2015 Q2 HK Macroeconomic Forecast

09 Apr 2015

1 Overview

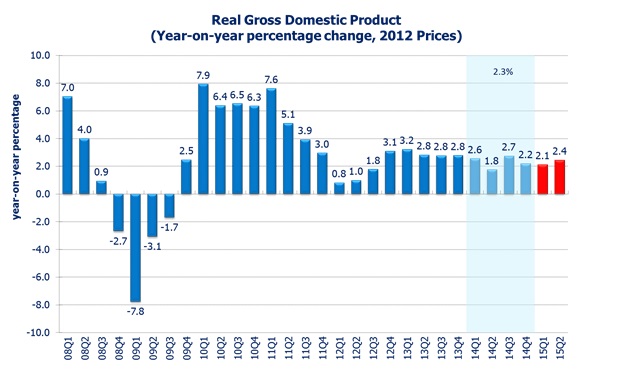

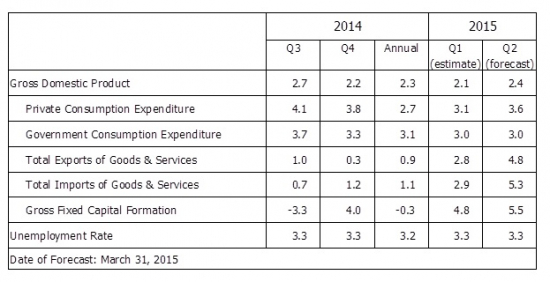

The APEC Studies Programme of the Hong Kong Institute of Economics and Business Strategy at the University of Hong Kong (HKU) released its quarterly Hong Kong Macroeconomic Forecast today (April 9). According to its High Frequency Macroeconomic Forecast, real GDP in 15Q1 is estimated to grow by 2.1% when compared with the same period in 2014. This is a downward revision from the previous forecast release of 2.4% (January 6). This revision reflects the slightly more cautious consumer spending in the form of private consumption, as well as exports of services.

In 15Q2, real GDP growth is forecast to be 2.4% when compared with the same period last year.

“Despite bumps, global demand continues to recover. Loose monetary policies world-wide and lower oil prices remain the major drivers. With such stimulation, the recovery of the US and EU is expected to pick up; Japan and Korea will likely avoid steep recession, if any. On the other hand, China will likely maintain noticeable growth in 2015, though at a slightly slower rate than 2014. The overall recovery of global demand will benefit Hong Kong.

US dollar has appreciated much against major currencies, and so has Hong Kong dollar due to its peg to the US dollar. US dollar and HK dollar-denominated goods and services appear more expensive and thus less attractive. Its adverse effect on Hong Kong economy will be felt gradually.

Taken these developments into consideration, Hong Kong’s economy is expected to grow at 2.3% in the first half of 2015, just marginally lower than the 2.5% recorded in the second half of 2014. Further improvement is likely in the second half of 2015,” said Dr. Wong Ka-fu, Principal Lecturer of Economics at HKU.

Among the various components, the growth in local demand is expected to cause a positive 3.1 percentage points GDP growth in the first half of 2015; and the external demand is expected to weigh down the GDP growth by 0.8 percentage point. The negative contribution of external demand is mainly due to the recent sharp appreciation of trade weighted effective exchange rate. The recent sharp appreciation causes an increase in the price of exports and a decrease in the price of imports, and consequently depresses exports and favors imports.

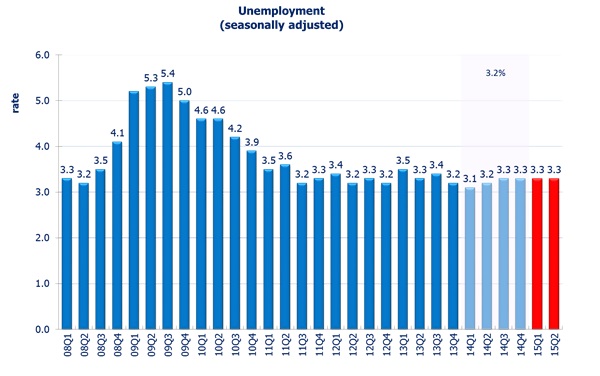

The labour market is expected to remain tight. The unemployment rate is projected to stay at 3.3% in 15Q2, same as 15Q1. Inflation is expected to be stable in the near term. The headline consumer inflation rate is forecast to be 3.8% in 15Q2.

The forecast details are in appendix Table 1 and Table 2, and the forecasts of selected monthly indicators are in Table 3 (tables attached). All growth rates reported are on a year-on-year basis.

2 Domestic Demand

2.1 Private Consumption

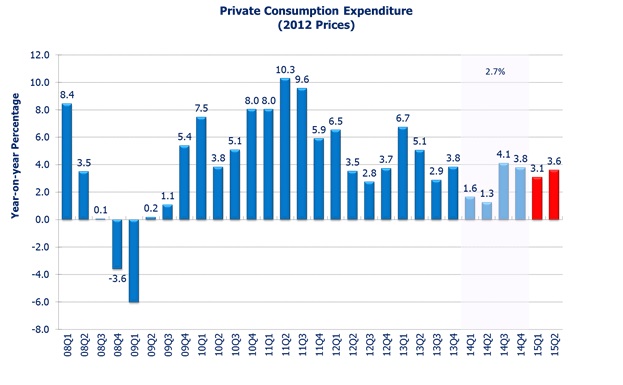

Amid buoyant labour market and desirable labour wage growth, consumer confidence is seen to stay relatively high in the first half of 2015. Last year, private consumption grew by 3.8% in 14Q4, slightly slower than the 4.1% in 14Q3. With the relatively high consumer confidence, we expect private consumption to do reasonably well, growing at a rate of 3.1% in 15Q1 and 3.6% in 15Q2.

2.2 Retail Sales

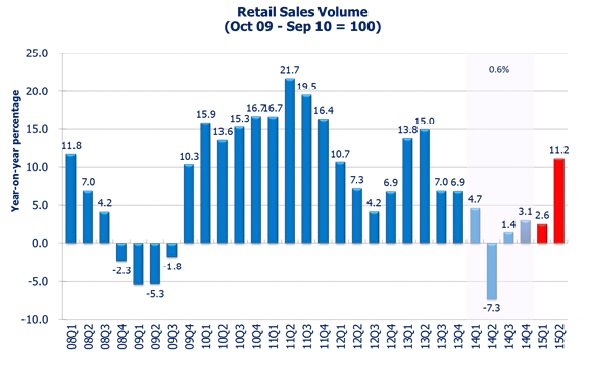

A striking drop of 13.8 % in the volume of retail sales was recorded in January 2015 when compared to the same period last year. Subsequently in February, a rebound of 18.2% was recorded. Such abrupt fluctuation was mainly due to the timing shift of Chinese Lunar New Year. Due to the change in retail sales pattern around Chinese Lunar New Year, retail sales figures are better looked at by aggregating the monthly data around the New Year. Indeed, if we take the first two months together, the volume dropped by 0.3% only.

In any case, a mild slowdown of retail sales is registered whether we are looking at the first two months’ figures together or the recently released seasonally adjusted figures. Several recent developments might have contributed to this mild slowdown of retail sales: a mild economic slowdown of adjacent economies, the appreciation of US dollars, and the increased effort in enforcing certain regulations on cross-border parallel trading.

Consequently, retail sales growth in 15Q1 forecast to slow to 2.6%. We do expect a strong rebound at 11.2% growth in 15Q2, though, partly due to an exceptional lower base caused by the 7.3% drop a year earlier (i.e., 14Q2).

2.3 Gross Fixed Capital Formation

Gross fixed capital formation increased by 4.0% in 14Q4, reverting from the 3.3% drop in 14Q3. Gross fixed capital formation is expected to grow at similar rates, by 4.8% in 15Q1 and 5.5% in 15Q2.

3 External Demand

3.1 Goods

In the external sector, total exports of goods slowed from 1.0% in 14Q3 to 0.6% in 14Q4. In the first two months of 2015, the nominal total exports grew by 4.6%. In particular, good exports to US surged by 14.5% reflecting the roaring US demand for foreign goods. Total exports of goods is expected to accelerate and grow by 3.1% in 15Q1 and 5.1% in 15Q2.

The imports of goods accelerated from 0.5% in 14Q3 to 1.2% in 14Q4. In the first two months of 2015, the nominal goods imports rose by 3.9%. The substantial Hong Kong dollar appreciation against most major currencies caused foreign goods to appear cheaper to us. Retained import for local use surged by 8.3% in 14Q4 from 1.9% in 14Q3. The imports of goods is expected to pick up and grow by 2.8% in 15Q1 and 5.7% in 15Q2.

3.2 Services

Services exports reverted to drop by 0.7% in 14Q4. Inbound tourism is expected to grow but at a moderate rate. Visitor arrivals grew at 8.5% in December 2014 and slowed to a 2.8% growth in January 2015, partly due to the shift in timing of Chinese Lunar New Year.

The slowdown of the growth of inbound tourism can also be due to the physical capacity constraint. In addition, the recent appreciation of Hong Kong dollar against major currencies also makes Hong Kong a less appealing destination.

In addition to inbound tourism, trade related services also contribute to services exports. Indeed, a revival in goods exports seems to boost trade related services, which offsets the slowdown in tourism related services. Services exports are thus estimated to grow by 1.9% in 15Q1 and 3.6% in 15Q2.

Services imports recorded a growth of 1.3% in 14Q4. Outbound tourism for local citizen has increased as appreciation of dollars makes foreign goods and services more price attractive. Oil price cut led to lower fuel surcharge, making travelling less expensive. We expect the growth of services imports to accelerate to 2.9% in 15Q1. The growth is expected to lower slightly to a moderate 1.4% in 15Q2, partly due to a higher base of the previous year (14Q2 registered a relatively high 4.9% growth).

4 Prices

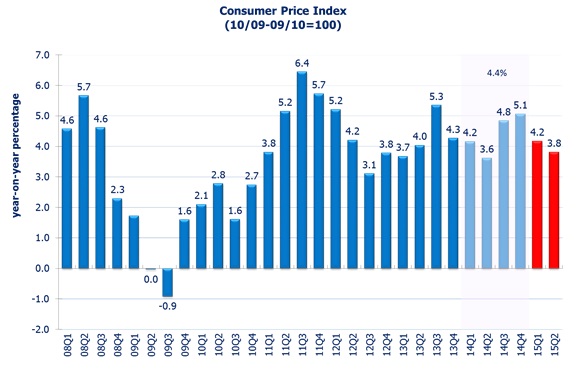

The general price level, as measured by the Composite CPI, rose by 4.6% in February 2015. The headline consumer-price based inflation rate is estimated to be 4.2% in 15Q1 and the rate would only be 2.4% in 15Q1 after stripping out the effect of rates concession and electricity subsidy implemented last year.

The appreciation of US dollar and the drop in oil prices has eased the imported inflation pressure. The consumer-price based inflation rate is forecast to be 3.8% in 15Q2, with underlying rate kept at 2.4% after netting out the government measures.

5 Labour Market

The provisional seasonally adjusted unemployment rate stood at 3.3% in the three months ending in February 2015 for eight consecutive months, reflecting a tight labour market condition. The unemployment rate is forecast to stay at 3.3% in 15Q1.

We expect the job market to stay tight throughout the year of 2015. The unemployment rate is forecast to stay at 3.3% in 15Q2. Comparing to 15Q1, we forecast 32,000 employment created and 7,000 persons increase in unemployment in 15Q2.

6 Concluding Remarks

6.1 US Interest Rate

An interest rate hike in the US is deemed likely in the second half of 2015. Civilian unemployment rate has dropped to 5.5% in February 2015 and real GDP grew at 2.2% in 14Q4. Such robust recovery of the US economy suggests that inflation pressure is mounting, if it were not contained by the plunge in oil prices and US dollar appreciation. Indeed, some Federal Reserve Board members have hinted the likely interest rate hike in June. The substantial dollar appreciation in recent months reflects the market expectation of interest rate hike.

Since quarter percentage increase of interest rate from the currently low interest rate can have substantial impact, the Fed will likely be very cautious in its decision. That is why the exact timing is difficult to tell.

Moreover, since our currency is pegged to the US dollar, Hong Kong has no other option but to match the interest rate hike of the US when it happens. As we all know, an interest rate hike will have an adverse impact on the economy via changes in investment and consumption decisions.

The general public should also be warned of the potential downward risk in asset and property prices in view of the likely interest rate hike in the near future. The downward risk in property prices is deemed higher because properties are often bought with a rather high leverage.

6.2 Appreciation of the US dollar

US dollar has appreciated much against the major currencies, and so has Hong Kong dollar due to its peg to the US dollar. US dollar and HK dollar-denominated goods and services appear more expensive and thus less attractive. For instance, office space and labor will appear much more expensive to foreign firms which are about to set up offices in Hong Kong; Hong Kong will become a less attractive tourist destination.

The impact of dollar appreciation on Hong Kong economy is wide spread. The extent of the impact depends on how long the US dollar stays at this level and how strong the other counteracting factors (such as the recovery in global demand) are. The lags in its effect of dollar appreciation on the economy is likely long and variable.

6.3 Protest against parallel trade

Protests against mainland parallel traders have been widely reported. There have been calls in society for various forms of restrictions on the number of visitors from the mainland via the individual visit scheme. There have been concerns about the adverse impact of the policy on the economy.

Our view is that such restriction will likely to have only limited impact on our economy. A recent report by the Government estimated that the individual visit scheme contributed 1.3% of GDP to the Hong Kong economy in 2012. That is, if individual visit scheme is removed completely today, the GDP of Hong Kong will be lowered by 1.3% once and for all. GDP growth will be lowered by 1.3% in the current year only but not in subsequent years. Of course, an abrupt and complete removal of the individual visit scheme is unlikely. The implementation, if any after lengthy discussions, is likely to be gradual over a long period of time. Therefore, the impact of any restriction on individual visit scheme is likely to spread out over many years and the impact on GDP growth is likely to be small in any given year. In addition, given the economy’s ability to adapt to economic changes, the adverse effect of any such restriction on economic growth is likely to be much smaller than 1.3%.

It should however be noted that the disruption caused by parallel trade to the life of people living in areas near the border will likely continue even if restriction on the scheme is imposed. Parallel trade is driven by profit, it will stop only when no longer profitable. A restriction on individual visit scheme will only shift the parallel trade operators from mainlanders to Hong Kong people. If the Government is really serious about reducing the extent of parallel trade, a more effective measure would be to increase the operation cost by introducing a small departure tax on passengers departing Hong Kong through land and water crossings (e.g., $10 dollars Departure Tax).

6.4 Conclusion

Clouded by the risk of interest rate hike and the US dollar appreciation, we remain optimistic in the short term. In the short run, we expect Hong Kong to have another modest growth year in 2015, supported by local demand throughout 2015 and external demand in the latter part of 2015. Hong Kong’s real GDP is expected to grow by 2.8% in 2015 for the year as a whole, likely between 2.5% and 3.1%, slightly higher than the 2.3% growth in 2014.

About Hong Kong Macroeconomic Forecast Project

The Hong Kong Macroeconomic Forecast is based on research conducted by the APEC Studies Programme of the Hong Kong Institute of Economics and Business Strategy at HKU in the Faculty of Business and Economics. It aims to provide the community with timely information useful for tracking the short-term fluctuations of the economy. The current quarter macro forecasts have been released on a quarterly basis since 1999.

The high frequency forecasting system was originally developed in collaboration with Professor Lawrence Klein of the University of Pennsylvania in 1999-2000. Since then, the system has been maintained and further refined by the APEC Study Center which is now a research programme area of the Hong Kong Institution of Economics and Business Strategy.

The project is sponsored by the Faculty of Business and Economics and led by Dr. Ka-Fu Wong, Principal Lecturer of Economics at HKU. The Hong Kong Centre for Economic Research at HKU provides administrative support to the project. Researchers at the Hong Kong Institution of Economics and Business Strategy are solely responsible for the accuracy and interpretation of the forecasts. Our quarterly forecasts can be accessed at: http://www.hiebs.hku.hk/apec/macroforecast.htm

For media enquiries, please contact the HKU Hong Kong Institute of Economics & Business Strategy, tel: 2548 9300, email: info@hiebs.hku.hk.