Media

HKU announces 2015 Q1 HK Macroeconomic Forecast

06 Jan 2015

The overview and concluding remarks are attached below, for the full report, please click here.

Tables for analysis, please click here.

1 Overview

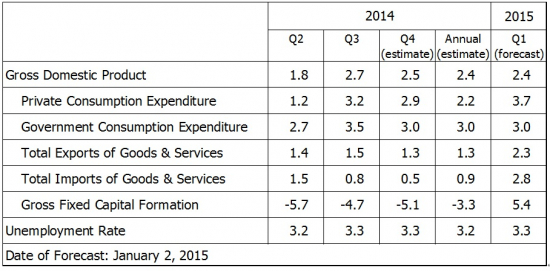

The APEC Studies Programme of the Hong Kong Institute of Economics and Business Strategy at the University of Hong Kong (HKU) released its quarterly Hong Kong Macroeconomic Forecast today (January 6). According to its High Frequency Macroeconomic Forecast, real GDP in 14Q4 is estimated to grow by 2.5% when compared with the same period in 2013. This is an upward revision from the previous forecast release of 2.1%. This revision reflects the stronger-than-expected private consumption.

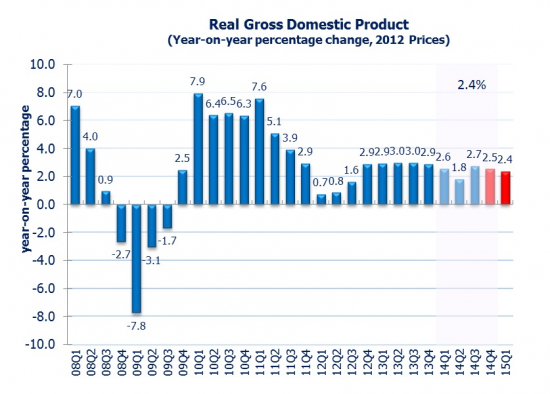

In 15Q1, real GDP growth is forecast to be 2.4% when compared with the same period last year.

Global demand has recovered moderately in 2014, especially in the second half. US economy extended stable growth from the second quarter’s 4.6% growth to the third quarter’s 3.9% growth in 2014, with US unemployment rate kept at 5.8% in November 2014. China’s economy is expected to grow by 7.4% in 2014.

With the moderate recovery of global demand and low interest rate environment, Hong Kong’s economy is expected to grow at 2.6% in the second half of 2014, slightly faster than the 2.2% in the first half. For the year of 2014 as a whole, Hong Kong’s real GDP is estimated to grow by 2.4%.

This annual growth of 2.4% appears to be driven by both domestic demand and external demand. Accounting for the contribution of various components to the growth, domestic demand contributes 1.5 percentage points and external demand 0.9 percentage point.

The labour market is expected to remain stable. The unemployment rate is projected to be 3.3% in 15Q1, same as 14Q4.

Inflation is expected to be stable in the near term. The headline consumer inflation rate is forecast to be 4.4% in 15Q1.

The forecast details are in appendix Table 1 and Table 2, and the forecasts of selected monthly indicators are in Table 3 (click here for tables). All growth rates reported are on a year-on-year basis.

6 Concluding Remarks

6.1 Impact of Occupy Movement

Despite the prolonged duration of the Occupy Movement (79 days), its impact on measurable economic activities (real GDP) appears negligible.

At the beginning of the Movement, the public seemed to worry that the Movement might adversely affect the economy via a decline in visitor arrival and retail sales. In our previous press release (dated October 8, 2014), we discussed the possible impact of the Movement on economic activities (measured by real GDP). A scenario put forth was for visitor arrival and retail sales to drop by 10% for a month. In such case, real GDP growth was expected to lower by approximately 0.4%. It turns out from the data that there has essentially been no adverse effect of the Movement on visitor arrival and retail sales, which is consistent with our analysis.

One explanation is that visitors and retail sales were able to avoid the several districts severely affected by the movement, namely Admiralty, Causeway Bay and Mongkok. The media reported widely that some businesses in these districts had been adversely affected, hence giving an impression that the whole economy was heavily impacted. In fact, at least as revealed by our data, adverse impact of the Movement was likely to be concentrated in specific districts and major business activities were not dampened.

We agree that there are other costs to the general public, for example, additional commuting time and psychological distress. These costs are difficult to quantify and are not part of the GDP measure, and thus not covered in this report.

Will the Movement cause loss in business confidence and consequently slower growth? It is true that gross fixed capital formation is the most volatile among the GDP components, since business tendency is very sensitive to changes in domestic as well as external environment. In general, for every 5% changes in gross fixed capital formation, output growth could be impacted by as much as 1%. It is possible that a pessimistic view of Hong Kong’s business environment may cause a drop in gross fixed capital formation and hence a drop in the output growth.

Nevertheless, loss of business confidence due to the Movement is possible but unlikely, at least in the short term. The Movement might have caused short-term stress to businesses but the fundamental factors that attract businesses to Hong Kong remain intact. These factors include the rule of law, free flow of information, Hong Kong’s role as a gateway to China, low tax rate, world class infrastructure, etc. As long as there is no drastic deterioration of these factors, we remain optimistic.

6.2 Uncertainty due to external development

The impact of external development on output growth is likely to be deeper than that of the Occupy Movement.

In 2014, the global economy went diverging in different continents. The US started slow and picked up by the 2014 year end, and is now preparing a monetary tightening in 2015; Japan went sluggish, intervening by quantitative easing; EU bottomed out but remained weak; China plateaued, still with sizeable growth momentum; oil prices has fallen substantially, Russia is in a crisis. We are cautious of the macro-economic impact of these developments, especially the unfolding in the Russian market. These external developments add much uncertainty to Hong Kong’s economic outlook of 2015.

The robust US recovery has increased the chance of raising target interest rate, and hence the recent notable dollar appreciation. Our external demand will likely benefit from the US recovery but be hurt by the US dollar appreciation. Netting out, we expect an improvement of external demand due to the US factor.

At the same time, US dollar appreciation will also help constrain the imported part of inflation. Nevertheless, such passing through can take a while.

Despite the expected on-going nominal wage growth, inflation offsets part of growth, and consequently limits the growth of real wage and hence that of purchasing power. Indeed, we have seen a negative real wage growth in 14Q3 and this situation will likely continue for a few quarters. A negative real wage growth and the consequent decline in purchasing power may constrain the growth of private consumption.

While the chance of seeing a rise of interest rate target by the US in the first half of 2015 is high, the step will likely be small and infrequent. Therefore, we expect private consumption and capital formation to continue to benefit from the low interest rate environment.

Evaluating all these factors, we would expect Hong Kong to have a modest growth in 2015, mainly supported by optimistic local demand. Hong Kong’s real GDP growth in 2015 is expected to be around 2.9%, likely between 2.3% and 3.3%, marginally better than the estimated 2.4% growth of 2014.

For media enquiries, please contact the HKU Hong Kong Institute of Economics & Business Strategy, tel: 2548 9300, email: info@hiebs.hku.hk.