Media

HKU announces 2015 Q4 HK Macroeconomic Forecast

06 Oct 2015

1 Overview

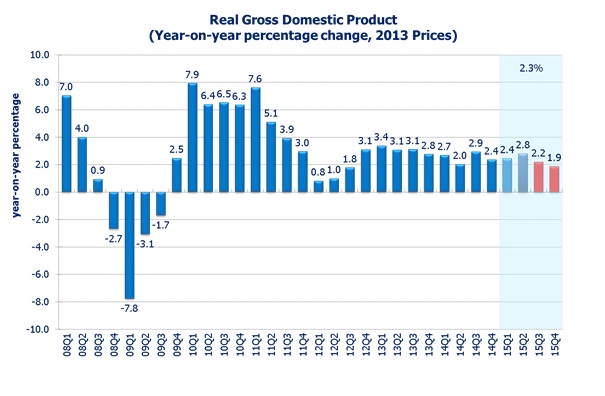

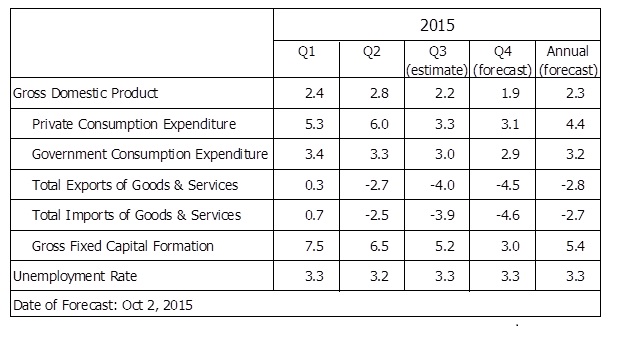

The APEC Studies Programme of the Hong Kong Institute of Economics and Business Strategy at the University of Hong Kong (HKU) released its quarterly Hong Kong Macroeconomic Forecast today (October 6). According to its High Frequency Macroeconomic Forecast, real GDP in 15Q3 is estimated to grow by 2.2% when compared with the same period in 2014. This upward revision from the previous forecast release of 1.7% (July 7) partly reflects the stronger-than-expected growth in private consumption in 15Q2.

In 15Q4, real GDP growth is forecast to be 1.9% when compared with the same period last year.

“Amid the US recovery, higher money demand in US dollars translated into currency appreciation. As we had adopted the linked exchange rate system with US dollars, the recent US dollar appreciation weakened Hong Kong’s external trade competitiveness. China economic slowdown also held back our economic growth. The recent monetary easing implemented in China will help stimulate the economy but its effect is likely to be long-term with variables. Consequently, Hong Kong’s output growth will likely be driven by our domestic demand in the rest of 2015.

Hong Kong economy is expected to grow by 2.0% in the second half of 2015, slowed from the 2.6% growth in the first half of 2015. The real GDP is forecast to grow by 2.3% for the year of 2015 as a whole. The real GDP growth is mainly driven by domestic demand. The increase in domestic demand is estimated to account for 2.6 percentage points of the overall increase in real GDP in current year, while the external demand is expected to contribute a negative 0.3 percentage point.

Hong Kong’s economy is expected to grow by 1.9% in 15Q4, moderated from the 2.2% estimated growth in 15Q3 due to the plunge in external trade.

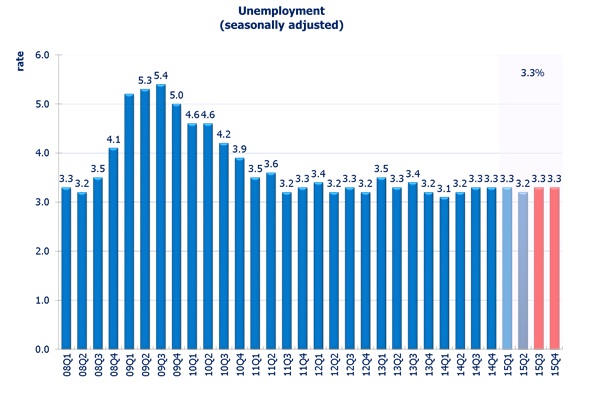

The labour market is expected to be stable with the unemployment rate projected to remain at 3.3% in 15Q4. Inflationary pressure is expected to ease as the US dollar appreciation lessens imported inflation. The headline consumer inflation rate is forecast to be 2.3% in 15Q4,” said Dr. Wong Ka-fu, Principal Lecturer of Economics at HKU.

The forecast details are in appendix Table 1 and Table 2, and the forecasts of selected monthly indicators are in Table 3 (tables attached). All growth rates reported are on a year-on-year basis.

2 Domestic Demand

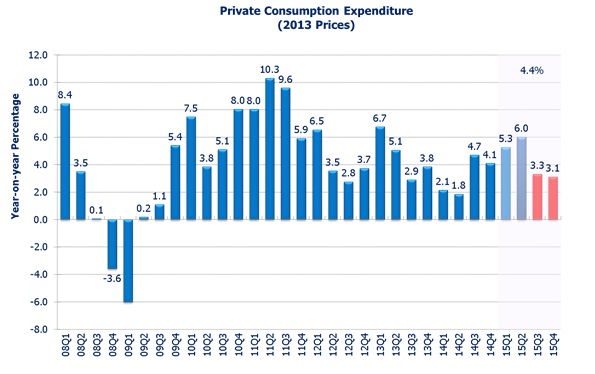

2.1 Private Consumption

Private consumption grew by 6.0% in 15Q2. Dampened by cautious consumer spending, private consumption is projected to moderate and grow by 3.1% in 15Q4, slightly lower than the estimated 3.3% increase in the 15Q3. For the year as a whole, private consumption spending is forecast to grow by 4.4%.

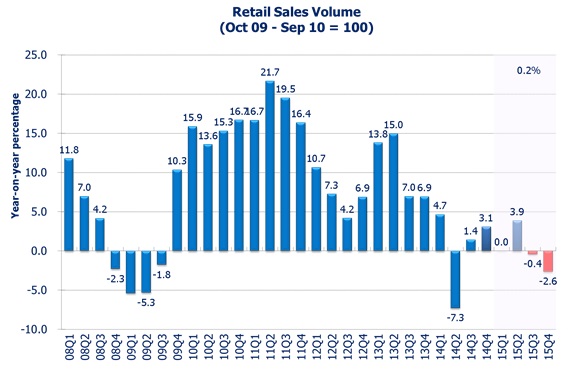

2.2 Retail Sales

The volume of retail sales dropped by 0.2% in August 2015, reverting from the consecutive annual growth in the past six months since February 2015. Given the reduction of visitors’ spending, the phasing in of “one-week-one-visit” visa policy and weaker consumer sentiment brought by the stock price adjustment, retail sales is projected to be subdued in the current quarter. The drop in the volume of retail sales is estimated to drop by 0.4% in 15Q3, reverted from the 3.9% growth in 15Q2. In 15Q4, we forecast retail sales worsening to fall by 2.6%. For the year of 2015 as a whole, it is projected to grow by 0.2%.

2.3 Gross Fixed Capital Formation

Gross fixed capital formation grew by 6.5% in 15Q2, slowed from the 7.5% growth in 15Q1. Given the higher interest rate expectation, investment decisions turn more cautious. Growth in gross fixed capital formation is restrained to grow by 5.2% in 15Q3 and further down to 3.0% in 15Q4. For the year of 2015 as a whole, it is estimated to grow by 5.4%.

Gross fixed capital formation in land and construction is expected to grow by 4.4% in 15Q3, 1.9% in 15Q4 and 4.9% for the year of 2015 as a whole. Gross fixed capital formation in machinery, equipment & computer software is expected to rise by 6.1% in 15Q3, 4.1% in 15Q4 and 5.9% for the year of 2015 as a whole.

3 External Demand

3.1 Goods

In the external sector, total exports of goods reverted from a 0.4% increase in 15Q1 to a 3.6% decrease in 15Q2. In particular, goods exports to Mainland China dropped by 6.1% in nominal terms in August 2015 reflecting the economic slowdown of China.

The US dollar appreciation weakened Hong Kong’s price competitiveness against foreign goods. Also, the fall in Mainland’s demand has contributed much to the overall decrease in our total export. The exports to Mainland accounts slightly more than a half of our total export in August 2015. Thus, total exports of goods is expected to decrease by 5.0% in 15Q3, 5.5% in 15Q4 and 3.6% for the year of 2015 as a whole.

The imports of goods is expected to decrease by 4.6% in 15Q3, 5.3% in 15Q4 and 3.4% in 2015 as a whole. The decrease is mainly caused by the weak export performance because a big trunk of Hong Kong’s imports are driven by exports demand.

3.2 Services

Services exports rose by 1.0% in 15Q2. Inbound tourism growth is expected to be moderate due to the appreciation of Hong Kong dollar, making Hong Kong a less price attractive destination. With the more restrictive one-week-one-visit visa policy and active promotion on tourism by other Asian and European countries, visitor arrivals dropped by 8.4% in July 2015 and 6.6% in August 2015, the weakest since 09Q2 (the middle of the subprime turmoil).

The contraction in goods exports also drives down trade related services exports. Service exports is estimated to drop by 0.4% in 15Q3 and further down to 0.8% in 15Q4. For the year of 2015 as a whole, service exports is estimated to drop by 0.1%.

Outbound tourism was vibrant as US dollar appreciation makes foreign goods and services cheaper. Services imports recorded a growth of 4.3% in 15Q2. We expect the growth of services imports to be a moderate 2.1% in 15Q3. The growth is expected to be 1.8% in 15Q4 and 3.5% for 2015 year as a whole. The moderation is mainly due to the reduction in trade related imports of services.

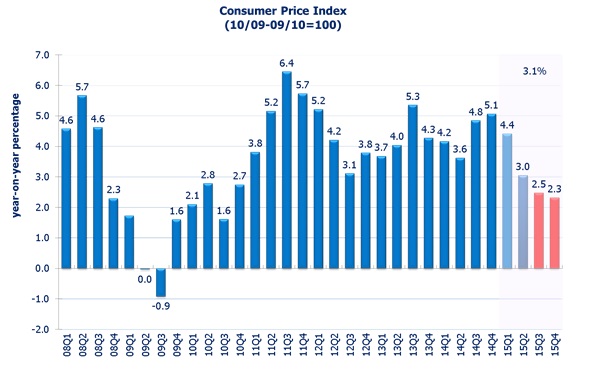

4 Prices

The general price level, as measured by the Composite CPI, rose by 2.4% in August 2015. Brought by the appreciation of US dollar easing the imported inflation pressure, as well as stable food and energy prices, the headline consumer-price based inflation rate is estimated to be 2.5% in 15Q3, moderated from the 3.0% in 15Q2. It is forecast to be 2.3% in 15Q4. For the year of 2015 as a whole, inflation is projected at 3.1%, lower than the 4.4% in 2014.

5 Labour Market

The provisional seasonally adjusted unemployment rate stood at 3.3% in the three months ending in August 2015. Reflecting the tight labour market, Hong Kong’s unemployment rate has remained at low level compared to other developed economies. We expect the job market to stay tight in the upcoming quarters. The unemployment rate is forecast to stay at 3.3% in 15Q3, 15Q4 and the year of 2015 as a whole. Comparing to 15Q3, we forecast 10,000 jobs created with labour force reaching 4 million persons in 15Q4.

6 Conclusion

US full economic recovery has been confirmed by the robust GDP growth of 3.9% in 15Q2 and the civilian unemployment rate at its seven-year-low of 5.1% in September 2015. A rise in interest rate is almost immediate. A rise in US interest rate could result in a further US dollar appreciation and hence a deterioration in Hong Kong’s exports.

Due to our linked exchange rate against the US dollar, Hong Kong’s interest rate will also rise whenever there is a hike in US interest rate. Needless to say, interest is a cost of all kind of asset investment and consumption. This additional channel will further constrain Hong Kong’s economic performance.

External threats could hold back our economic growth as well. China is clouded by economic slowdown, high volatility in stock market and hiking in debt-to-GDP ratio. In the European front, terrorism plunges Syria into greater uncertainty causing the influx of migrant to Europe. Although the economic effect is not imminent, the impact could be deep and prolonged. All of these will put business sentiment on hold.

In short, we expect Hong Kong’s economic growth to slow down further in the near future.

About Hong Kong Macroeconomic Forecast Project

The Hong Kong Macroeconomic Forecast is based on research conducted by the APEC Studies Programme of the Hong Kong Institute of Economics and Business Strategy at HKU in the Faculty of Business and Economics. It aims to provide the community with timely information useful for tracking the short-term fluctuations of the economy. The current quarter macro forecasts have been released on a quarterly basis since 1999.

The high frequency forecasting system was originally developed in collaboration with Professor Lawrence Klein of the University of Pennsylvania in 1999-2000. Since then, the system has been maintained and further refined by the APEC Study Center which is now a research programme area of the Hong Kong Institution of Economics and Business Strategy.

The project is sponsored by the Faculty of Business and Economics and led by Dr. Ka-Fu Wong, Principal Lecturer of Economics at HKU. The Hong Kong Centre for Economic Research at HKU provides administrative support to the project. Researchers at the Hong Kong Institution of Economics and Business Strategy are solely responsible for the accuracy and interpretation of the forecasts. Our quarterly forecasts can be accessed at:

http://www.hiebs.hku.hk/apec/macroforecast.htm

For media enquiries, please contact the HKU Hong Kong Institute of Economics & Business Strategy, tel: 2548 9300, email: info@hiebs.hku.hk.